Obama wants to have a discussion about income inequality and increasing the discriminatory nature of the income tax rate structure to reduce income inequality. He claims he will win that debate. He clearly believes the American People are merry thieves and covet their neighbor's income if not his wife, his house, his manservant or maidservant, his ox or his donkey, or anything else that is his. I hope he is wrong and that most Americans will resist the Obama lure for free government goodies and services paid for by soaking the rich.

An increasing number of Americans, especially Tea Party Americans, do seem to think there is nothing wrong with others becoming rich and they even wish them the best. Many have dreams of becoming rich themselves. Unfortunately, the young Americans coming out of our government-run school systems have generally been indoctrinated in the idea that income inequality is a great social injustice that transcends such trends as a generally improving lifestyle for all income groups. They have been taught that those with high incomes have somehow deprived the poor or that they must give back what they have created because, well they somehow could not have created it but for the poor? Or, in some cases, the rich are pictured as actually having taken more of their share of the dwindling resources of the planet and added more than their share of pollution, so therefore they must be made to pay back the poor whose share of resources and clean air and water they took! This is nonsense that comes from static thinking and environmental misconceptions I have discussed elsewhere.

The Progressive Socialist Elitist likes to point at the fact that the very wealthy are becoming wealthier at a faster rate than most Americans have been becoming wealthier. He commonly claims this growing wealth on the part of the very rich is due to the Bush II tax cuts. He does not point out that the rate of the increased share of total income going to the wealthiest 10% of Americans grew just as fast from 1994 to 2000 under Bill Clinton. He does not point out that the share of total wealth of the top 10% has risen since 1978, which was back in Jimmy Carter's administration! Let us look at the historical data of Piketty and Saez (2003) and the

update by Saez through 2007 for the share of total income held by the top 10% of tax filers including wages and salaries, pensions received, profits from business, dividends, interest, rents, and capital gains, but excluding Social Security retirement benefits, unemployment payments, and other government transfer payments:

In 2007, the bottom income for the top 10% in income was $109,630, so we are hardly talking about really wealthy or really high income families here. Saez' 2007 update provides a further breakdown on how the shares of those between the 90th and 95th percentiles ($109,630 and $155,400 in 2007), those between the 95th and 99th percentiles ($155,400 and $398,900 in 2007), and the top 1 percentile with annual income above $398,900 fared historically:

We see that those with incomes in the 90th to 95th percentile range actually lost share in the total national income from 2003 to 2007 following the Bush tax cut and overall had no greater share than they did in about 1970, though they were better off than in the 1940s and 1950s. So, if income inequality actually were a legitimate issue of social justice, there is no reason to increase tax rates on this group. If we then examine the group from 95% to 99% of income, we see they increased their share somewhat from 1982 to 1995, but have been rock steady ever since at the same fraction of the national income. There sure is no reason to increase taxes on this group based on some specious argument that the Bush tax cuts caused them to become proportionately wealthier. This would argue that tax rates for those earning up to about $400,000 should not be increased based on the specious argument that that would serve social justice by eliminating an increasing wealth inequality! We are left with only the top 1% of income earners as the sole group of the "rich" whose share of the national income has increased. They are the sole group making the entire top 10% of earners look as though they have increased their share of the national income. Their income share has generally increased since 1978, though recessions cause sharp reductions in their share.

So, what is Obama talking about when he diatribes on the social justice need to increase tax rates for those families with incomes greater than $250,000 a year or those single filers with incomes above $200,000 per year? Apparently, he just wants more of their money so he can exercise the power that comes with distributing it as he pleases for maximal political payback. We can understand this greed and power lust, but we need not label it as virtue. The Obama and the Progressive Socialist Elitist game is one of simple power lust. It is an effort to dangle government goodies before a majority of the population who do not pay their fair share for the goodies they are to receive. Indeed, let us examine the share of taxes paid compared to the share of national income earned by income groups to evaluate fairness on a more meaningful scale.

Now we can see that the top 1% of income earners had a 22.8% share of total income in 2007, but paid a far larger share of total income taxes at 40.4%. The 95% to 99% group of top earners had a 14.6% share of total income, but also paid a share of income taxes which was much larger than that at 20.2%. Our tax code clearly discriminates against them, even though we saw above that their share of total income has not increased since 1995 when Bill Clinton was President and still in his first term of office. The group of earners between 90% and 95% had equal shares of total income and of total income taxes at 10.6% of each. All but the top 10% of earners paid less into income taxes than their share of the national income! In effect, they all received a subsidy paid for by the top 5% of income earners. This was especially true for the bottom 50% of earners who paid only 2.9% of the total income tax amount in 2007! Basically, they can vote for just about any wasteful and illegitimate government program because it will be using someone else's money. They have no stake in the game. This is by design and exactly how the Progressive Socialist Elitist wants it. They want this half of the electorate to believe in free lunches, which is what this tax system gives them, except insofar as any of them may realize that hurting the higher income groups actually does hurt the economy.

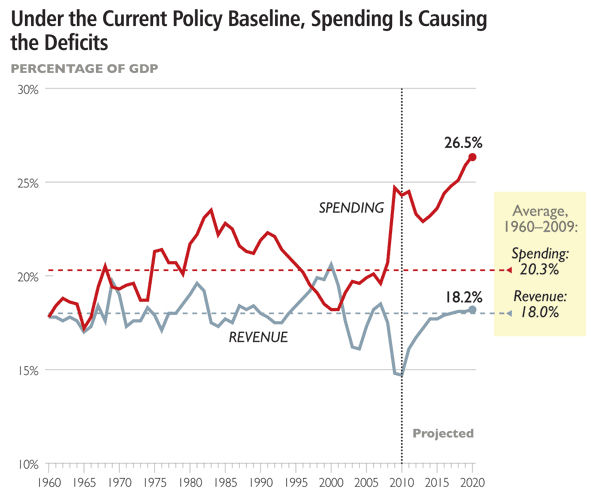

The unfairness we are actually dealing with in America is the unfairness of stealing the earnings of those who have worked hard and effectively to create wealth, which allows them to be paid well or to use a part of that created wealth as income from their businesses and investments. These activities do contribute greatly to the growth of the economy and to the decreasing cost of many necessary, or at least desired, goods and services. With high taxes, we force the higher income earners to move their investments from the highest yielding investments into those with tax protections such as municipal bonds or we force them to hold unto their investments longer so they will pay capital gains taxes more infrequently. Higher tax rates have always slowed down growth rates by making investment less efficient and by taking more of the time of the high earners due to their having to find ways to minimize loses to taxes. The net result in tax revenues is that whatever the marginal tax rates are set at, the actual federal government revenues do not rise above about 19% of GDP. This limit is called Hauser's Law.

Increasing tax rates on the wealthy may make a Progressive Socialist Elitist feel good, but it does not actually increase tax revenues. This, in a rational society, would keep them from claiming they are increasing rates on the wealthy in order to do more to help the poor and the needy with additional government programs. Interestingly enough, Obama seems to understand this at times and is more inclined to use the argument that he simply hates the wealthy having so much income and he is eager to do anything he can to take more of it from them. He covets their income and thinks most voters do also.

Simple fairness would have tax marginal rates the same for everyone with income above about the 20% level. Most of us are fine with the idea that government should not take food and other necessities out of the mouths of the poorest among us to fund government programs. Of course those who are rational also want a much, much smaller government exercising only constitutional powers and serving only to protect individual rights. With a legitimate government being about one-quarter its present size, the tax burden on everyone would be much lighter. It would be easy to have no deficits and to pay off the national debt, thereby eliminating the interest payments on that debt. It would be easy to eliminate business taxes, so businesses could much more readily compete internationally and hire many more Americans. With lower taxes, everyone, most especially the hardest and most efficient earners would be able to create more wealth and grow the economy. This would make it easier by far for every segment of the population to improve its standard of living, just as has clearly occurred in America from its founding and especially since after the Civil War.

It is important to remember that if you are truly interested in raising the general standard of living in the United States, that growth rates make a huge cumulative difference. When governments do not interfere with the individual's effort to make his life better, the growth rate of the economy can be increased substantially. Let us examine the effect on the size of the economy relative to its start size at the end of 20 years for the following growth rates:

2.0% growth yields an economy 1.49 times its initial size.

2.5% growth yields an economy 1.64 times its initial size.

3.0% growth yields an economy 1.81 times its initial size.

3.5% growth yields an economy 1.99 times its initial size.

4.0% growth yields an economy 2.19 times its initial size.

4.5% growth yields an economy 2.41 times its initial size.

5.0% growth yields an economy 2.65 times its initial size.

The only thing keeping the American economy from averaging 5% growth rates is the excessive size and interference of our local, state, and federal governments. The excessive services and waste is a sad substitute for the robust economy we would otherwise have. That economy would offer us many more choices tuned to our uniquely individual characters than does the retarded economy of a mixed socialist and capitalist system. Free capital and entrepreneurial talent and we will prosper in ways that governments cannot compete with the private sector to provide. What is more, we would then have a moral system allowing every individual to exercise the freedom of his own choices of values and exercising the personal control to manage his own life responsibly and in accordance with his personal values.

Substituting government coercion and threats of brutal force for the free individual choices of the free market and private sector is both immoral and impractical. Wise men find that moral behavior is favorably linked to practical flourishing in life! Some rational morality with respect to income tax fairness will yield a robustly growing economy and a better life for almost everyone. The few left out by the economy will easily be handled by a more robust charitable concern by free men and women.