10 March 2012

Sick Economy has More Missing Jobs than in February 2010!

The U.S. economy remains unable to provide the missing jobs that have plagued it since the start of the Great Recession which really began in the first quarter of 2008 with real per capita GDP started shrinking from its high at the end of 2007. Actual negative GDP growth started in early 2009. The number of missing jobs reached a peak in January 2010, but then that number reduced a bit, but started increasing again and reached another local maximum in January 2011. This tends to be the annual cycle, using the household survey numbers without seasonal adjustment as I do. The February 2012 employment numbers were just reported by the Bureau of Labor Statistics on Friday and they simply track the annual pattern of the last two years, with no sign of a recovery from the recession. A chart of the number of missing jobs is shown below:

If you compare the number of missing jobs in February for 2010, 2011, and 2012 one finds that the number has hardly changed at all:

February 2010, missing jobs = 22,747,000

February 2011, missing jobs = 23,108,000

February 2012, missing jobs = 22,935,000

But to be more precise, there are slightly more missing jobs in February 2012 than there were two years earlier in 2010 and slightly fewer missing jobs than in February 2011. There is no sign of progress in putting the many people back to work who have lost jobs in this Great Recession. The February employment numbers have improved over those of January, but they have done that each of the last two years also and by about the same amount.

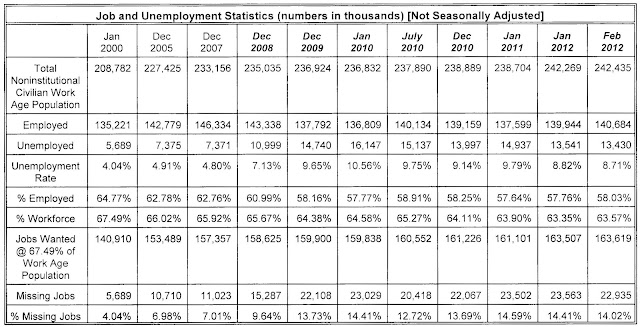

For those who have not been following my monthly analysis of the unemployment numbers, I calculate the number of jobs wanted based on the percentage of the non-institutional civilian working age population who wanted jobs in January 2000, which was actually already slightly lower than it was two to three years earlier than that. I subtract the number of employed people from the number of needed jobs and get the number of missing jobs. The calculations and numbers used are provided in the table below:

The real unemployment rate is 14.0%, which is slightly down from the real unemployment rate of January, as is usually true of February unemployment. The unemployment will fall into the summer and then start growing again until it will probably reach a maximum again in January 2013. This cycle is why only the seasonally adjusted unemployment numbers are usually discussed. However, the seasonal corrections made assume that the summer months will see a normal increase in outside jobs, such as construction jobs. But with the housing market so long depressed and there being no real prospect that housing and commercial construction will be at normal rates this coming summer, there is no real justification in making a normal winter size correction to the January and February employment numbers. In general, recessions will not behave in accordance with normal seasonal corrections and this is even more likely to be a problem in such a uniquely long recession.

As I have explained many times, this recession is one in which government policy has been very effective in prolonging the recession. The incredible level of uncertainty that Obama and his Democrat fiends have produced has very effectively suppressed gross private domestic investment to unheard levels and held that investment down for a very prolonged period. Without that investment there will be no significant job creation. Jobs lost in the early part of the recession in huge numbers cannot be recovered without much improved private investment. There is little likelihood of a significant improvement in business investment anytime this year, since Obama and the Democrats intend to stick to the wrongheaded policies that have deepened and prolonged this recession. If many of the 23 million Americans without jobs are to have them before too long, Obama and the Democrat-controlled Senate, which cannot produce a budget even, must be replaced. Throw these rascals out so millions of decent Americans can earn a living once again!

If you compare the number of missing jobs in February for 2010, 2011, and 2012 one finds that the number has hardly changed at all:

February 2010, missing jobs = 22,747,000

February 2011, missing jobs = 23,108,000

February 2012, missing jobs = 22,935,000

But to be more precise, there are slightly more missing jobs in February 2012 than there were two years earlier in 2010 and slightly fewer missing jobs than in February 2011. There is no sign of progress in putting the many people back to work who have lost jobs in this Great Recession. The February employment numbers have improved over those of January, but they have done that each of the last two years also and by about the same amount.

For those who have not been following my monthly analysis of the unemployment numbers, I calculate the number of jobs wanted based on the percentage of the non-institutional civilian working age population who wanted jobs in January 2000, which was actually already slightly lower than it was two to three years earlier than that. I subtract the number of employed people from the number of needed jobs and get the number of missing jobs. The calculations and numbers used are provided in the table below:

The real unemployment rate is 14.0%, which is slightly down from the real unemployment rate of January, as is usually true of February unemployment. The unemployment will fall into the summer and then start growing again until it will probably reach a maximum again in January 2013. This cycle is why only the seasonally adjusted unemployment numbers are usually discussed. However, the seasonal corrections made assume that the summer months will see a normal increase in outside jobs, such as construction jobs. But with the housing market so long depressed and there being no real prospect that housing and commercial construction will be at normal rates this coming summer, there is no real justification in making a normal winter size correction to the January and February employment numbers. In general, recessions will not behave in accordance with normal seasonal corrections and this is even more likely to be a problem in such a uniquely long recession.

As I have explained many times, this recession is one in which government policy has been very effective in prolonging the recession. The incredible level of uncertainty that Obama and his Democrat fiends have produced has very effectively suppressed gross private domestic investment to unheard levels and held that investment down for a very prolonged period. Without that investment there will be no significant job creation. Jobs lost in the early part of the recession in huge numbers cannot be recovered without much improved private investment. There is little likelihood of a significant improvement in business investment anytime this year, since Obama and the Democrats intend to stick to the wrongheaded policies that have deepened and prolonged this recession. If many of the 23 million Americans without jobs are to have them before too long, Obama and the Democrat-controlled Senate, which cannot produce a budget even, must be replaced. Throw these rascals out so millions of decent Americans can earn a living once again!

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment